Deferred NHL Contracts: How Seth Jarvis Saved the Hurricanes Cap Space (2024)

Seth Jarvis’ $63.2‑million extension shows how deferred salary cuts cap hit without cutting pay - proof this CBA‑approved tactic is here to stay.

How Deferred Contracts Affect the NHL Salary Cap

In the NHL, a player's cap hit is typically calculated by dividing the total contract value evenly across its term. But what if a team wants to pay the full amount - just not all at once? That’s the essence of deferred salary contracts and, in 2024, the Carolina Hurricanes used one to sign Seth Jarvis to a long-term deal that lowered his cap hit without lowering his pay.

This article explores how deferred contracts work, how they impact the NHL salary cap, and why Jarvis' deal might be a blueprint for future deals.

The Jarvis Deal: Cap Hit Reduction via Deferred Salary

On August 31, 2024, the Carolina Hurricanes signed Seth Jarvis to an 8-year, $63.2 million contract. A typical structure would yield a cap hit of roughly $7.9 million per year. Instead, the team used deferred salary payments to bring the cap hit down to $7.4 million - saving nearly $500,000 per year.

Jarvis agreed to delay a portion of his salary, receiving it years after the deal ends. While his total compensation remains unchanged, the present value of those deferred dollars is lower. And under the CBA, it’s the present value - not the raw dollar total - that determines a player's cap hit.

This technique isn’t new. The Phoenix Coyotes used a similar tactic in 2016 with Shane Doan. At age 39 Doan signed a one‑year $5 million contract. Then‑GM John Chayka mixed deferred salary with performance bonuses to drop the cap hit to just under $4 million. CapFriendly provided a full breakdown, still available on the Internet Archive.

Time Value of Money, NHL‑Style

To get how this works, we need an intuition about the concept of the Time Value of Money. Imagine you’re selling your old car and I offer you $1 billion for it. Sounds great, right? But what if I told you...

“Oh, by the way, the money is not transferable, and you won’t get it for 200 years.”

Well, that’s not so great. Why? Because you might want to spend some of that money now. And there’s some uncertainty about whether you’ll be able to collect in 200 years. Money today is worth more than the same amount in the future because you can use it immediately. This idea underpins every deferred‑payment contract.

Salary Cap "Loopholes": Signing Bonuses vs. Deferred Payments

Let’s talk about signing bonuses.

Right now, these are the most common way to exploit the time value of money. Take Auston Matthews, for instance. He signed a $53 million contract with a nearly $16 million signing bonus, payable on July 1st. If Matthews invests that bonus at a 10% annual return, he could earn an additional $1.6 million (this is not totally accurate but will help make the point) by the end of the year. Without the signing bonus, the team would have had to pay him an extra $1.6 million against the cap to achieve the same financial outcome. For teams with the means to pay such bonuses upfront, this provides a significant advantage in signing top players — without it being considered cap circumvention.

Deferred payments flip the script. Instead of paying upfront, what if the payment is deferred until after the contract ends? That’s exactly what the Hurricanes did with Jarvis. While the total amount remains the same, the current value of the deferred money is less because of things like interest rates and inflation. Another way to say this, is that the player is loaning money to the team over the course of the agreement, with the team paying it back later, with interest.

The CBA accounts for this by applying an interest rate to calculate the present value:

Interest Rate = Prime Rate + 1.25%

CBA Article 50, Section 2(a)(ii)(A)

Seth Jarvis Contract Breakdown

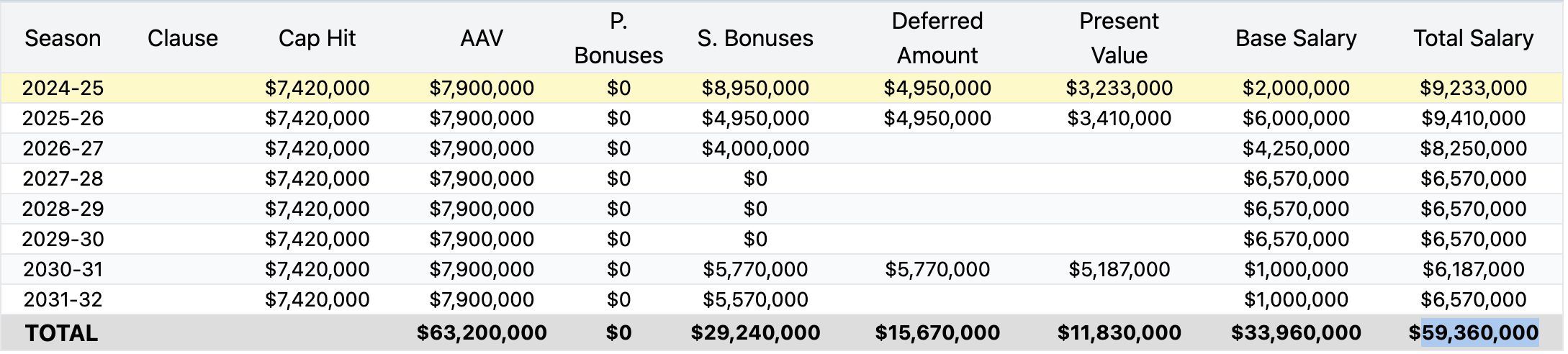

Let’s look at a practical example. Here are Jarvis’ contract details:

And this is a breakdown of the deferred payments:

- Total deferred amount: $15.67 million

- Deferred in years: 1, 2 and 7

- Interest rate: 5.47 % (4.22 % prime + 1.25 %)

The formula used to calculate the present value of the deferred payments is:

| Years Left | Deferred Amount | Interest Rate | Present Value |

|---|---|---|---|

| 8 | $4.95 million | 5.47 % | $3.233 million |

| 7 | $4.95 million | 5.47 % | $3.41 million |

| 2 | $5.77 million | 5.47 % | $5.187 million |

Over the life of the contract Jarvis will receive $63.2 million, but the cap hit reflects a present‑value total of $59.37 million - a savings of $3.83 million or $478,750 per season.

Final Thoughts

Why Would the League Allow This?

This structure offers clear benefits to team owners. Besides the obvious cap relief, it allows owners to retain more cash upfront. That up‑front liquidity can generate returns higher than the contractual interest. This also allows helps smaller‑market teams, without large signing‑bonus budgets stay competitive.

Why Would a Player Accept Deferred Payments?

Deferred income provides a guaranteed payout schedule and lowers immediate investment risk. Consider former Canadiens forward Steve Bégin, who recently filed for bankruptcy after a failed real‑estate venture. Deferred payments offer a more stable financial outlook.

Additionally, by agreeing to defer some of his salary, Jarvis helps the Hurricanes sign or retain other talent, boosting the roster during his prime years.

A New NHL Contract Trend?

Only a few players - Jarvis, Jaccob Slavin and Doan - have embraced this setup. Earlier in 2024 the Vegas Golden Knights proposed a similar deal to Jonathan Marchessault, but the winger declined. Many agents believe players can out‑earn the prime‑rate return by investing signing‑bonus money themselves.

EDIT (May 2025): Since this was written, 2 additional players have signed deferred contracts: Jake McCabe of the Toronto Maple Leafs and Frank Vatrano of the Anaheim Ducks. In response, the league and NHLPA are discussing removing the deferred payment options as they negote a new Collective Bargaining Agreement as reported by Pierre LeBrun.

Still, the approach is legally sound and offers clear cap savings. If teams convince more players that the trade‑off is worthwhile, deferred‑payment contracts could spread quickly across the league.

FAQs: NHL Deferred Salary and Salary Cap Implications

What is a deferred contract in the NHL?

A contract that delays a portion of a player’s salary beyond the playing years, reducing its present value and thus the cap hit.

Do deferred payments lower the salary cap hit?

Yes. The cap hit is based on the present value of total compensation using a CBA-defined interest rate.

Are deferred payments legal under the NHL CBA?

Yes. Article 50 of the CBA outlines how deferred payments are calculated and how they impact the cap.

Why don’t more NHL players use deferred contracts?

Most prefer upfront payment for investment flexibility. Deferred deals are still rare but may grow as teams push for cap efficiency.

Last updated: May 2025